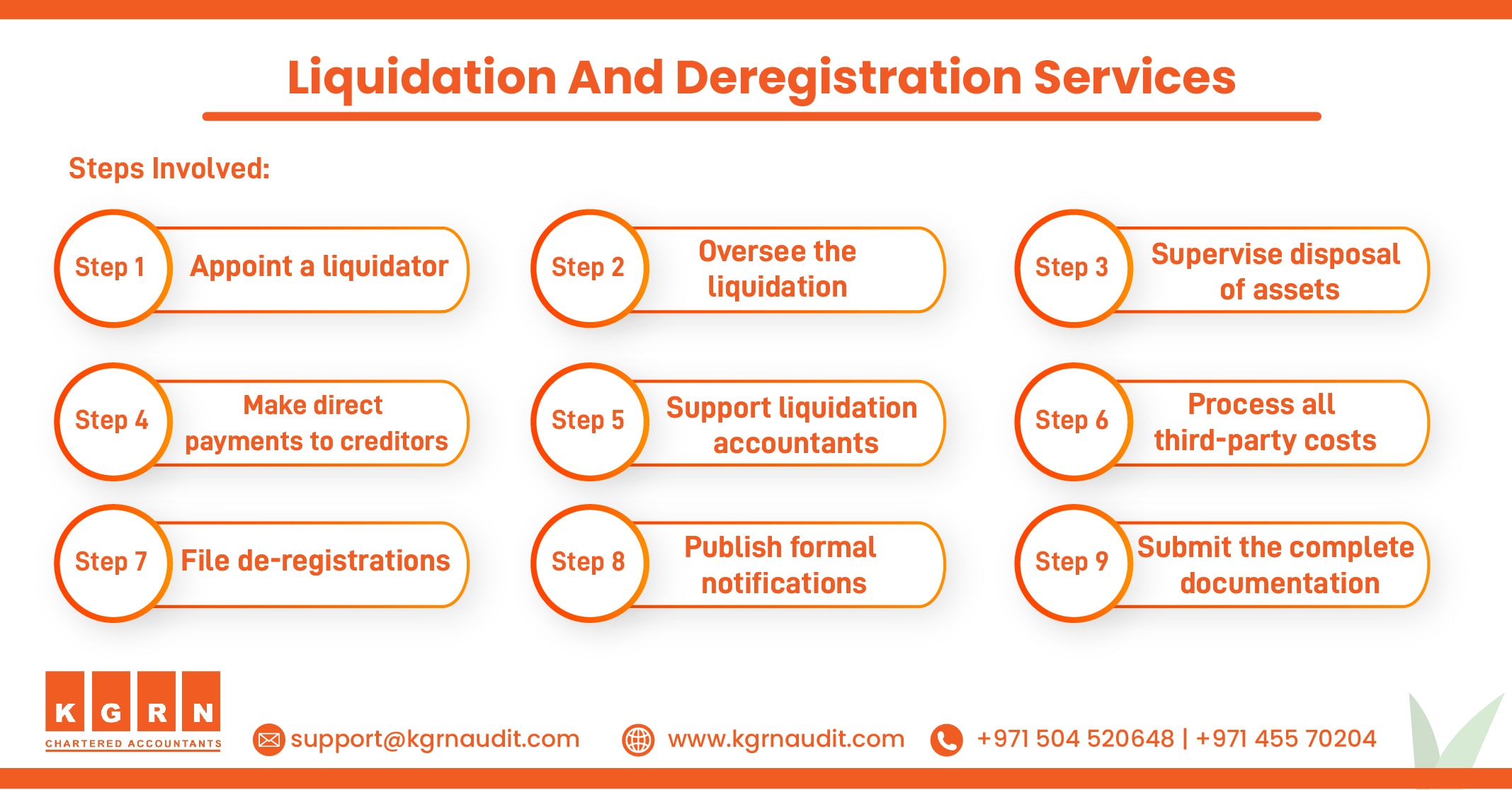

Company Liquidation and Deregistration in Dubai, UAE is the process when the company closes down its operations and the assets and property of the company are distributed to creditors and shareholders of the Company.

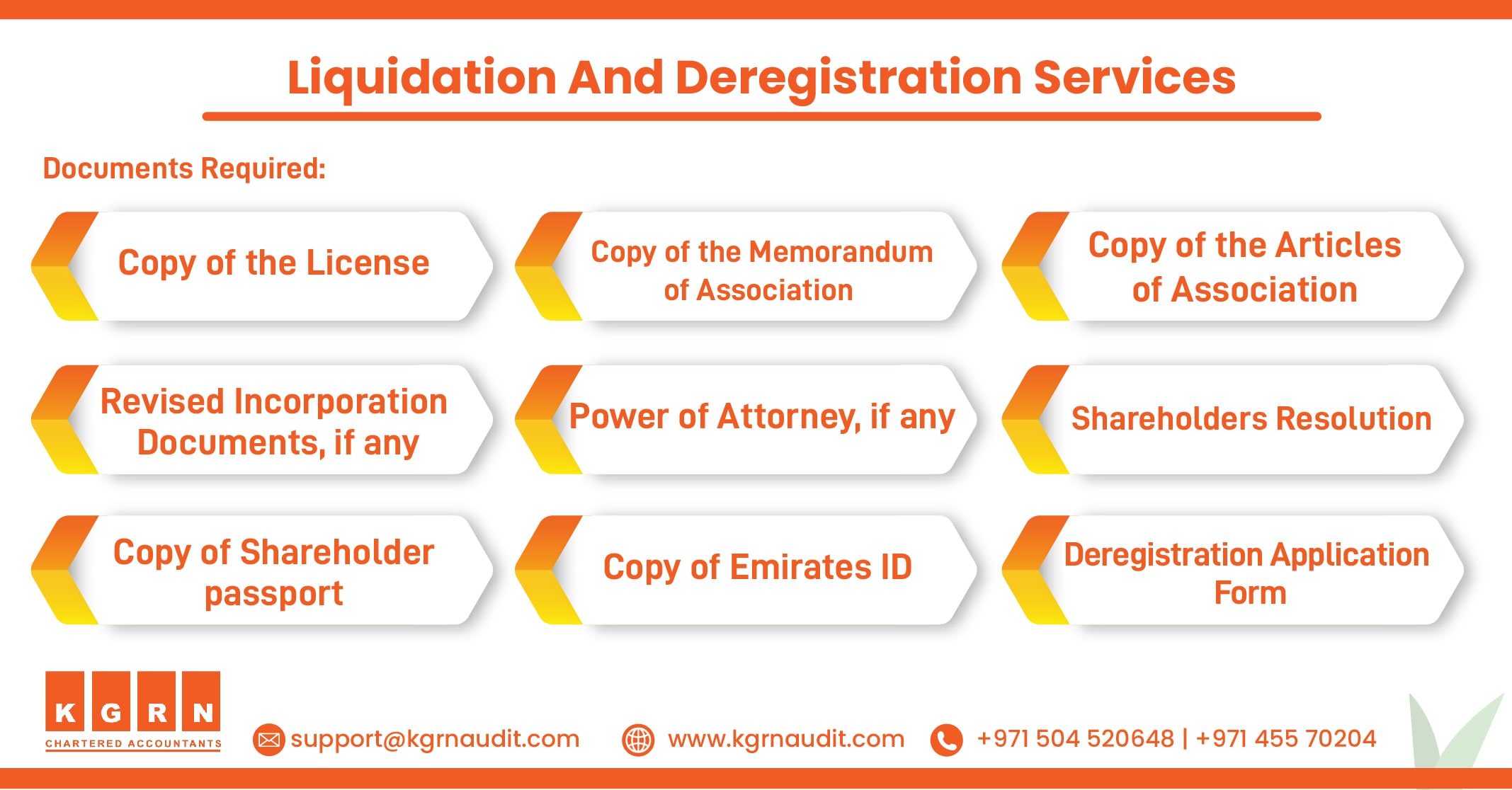

Company Liquidation and Deregistration Services in Dubai process may vary from one UAE Free Zone to another, but still, it is very similar for most of them. No matter what type of business you own in the UAE, you must cancel your business license and all related permits associated with it when you have made your decision to close it down. This page provides a summary of the formalities for closing your business and canceling its license properly.